Introduction to Click Fraud: A Silent Threat to Your Ad Budget

Imagine pouring your marketing budget into a paid advertising campaign, only to discover that a significant portion of your clicks—and your hard-earned money—are fake. This isn’t a far-fetched scenario; it’s a reality for many businesses facing the growing issue of click fraud. As digital advertising becomes a cornerstone of modern marketing, the risk of wasted ad spend due to invalid clicks from bots, click farms, or even malicious competitors looms large.

Click fraud directly impacts the effectiveness of pay-per-click (PPC) campaigns on platforms like Google Ads and Meta (Facebook and Instagram). For small and medium-sized businesses with limited budgets, this can mean losing thousands of dollars before even realizing there’s a problem. In this comprehensive guide, we’ll dive into what click fraud is, how it operates, why it’s a growing threat, and most importantly, how to implement click fraud prevention strategies to protect your ad spend.

What Is Click Fraud and Why Does It Matter?

Defining Click Fraud

Click fraud occurs when clicks on digital ads are generated with malicious intent rather than genuine consumer interest. These fraudulent clicks can come from automated bots, human-operated click farms, or even competitors trying to deplete your budget. The result? You pay for clicks that never convert into leads or sales, leading to significant wasted ad spend.

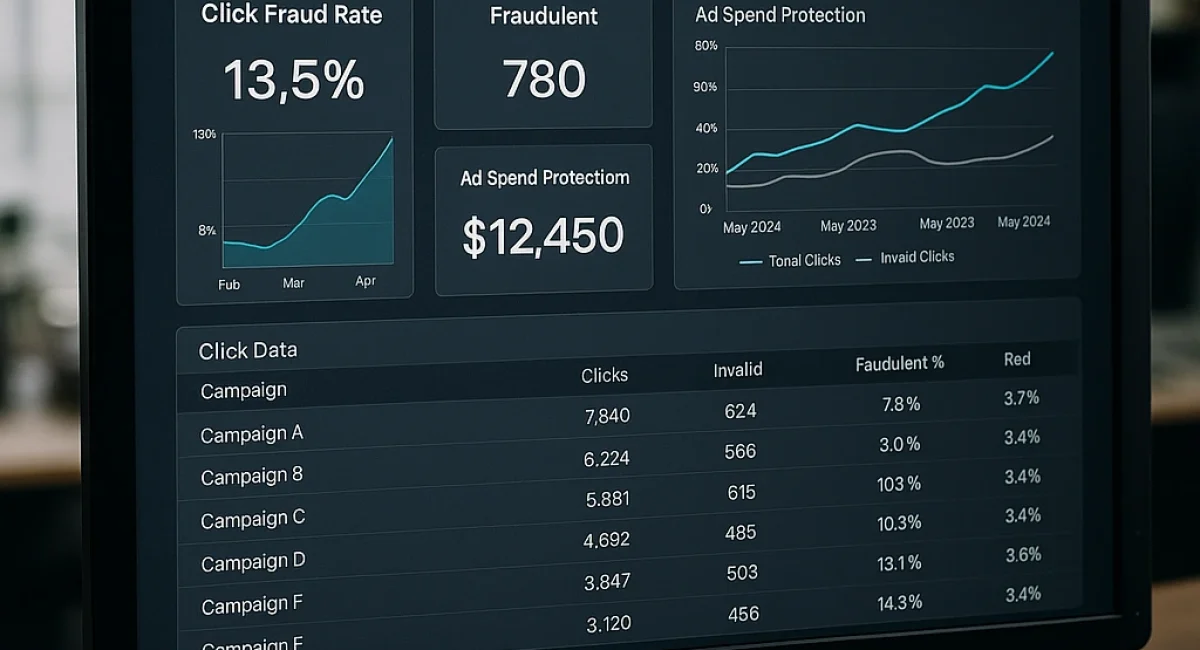

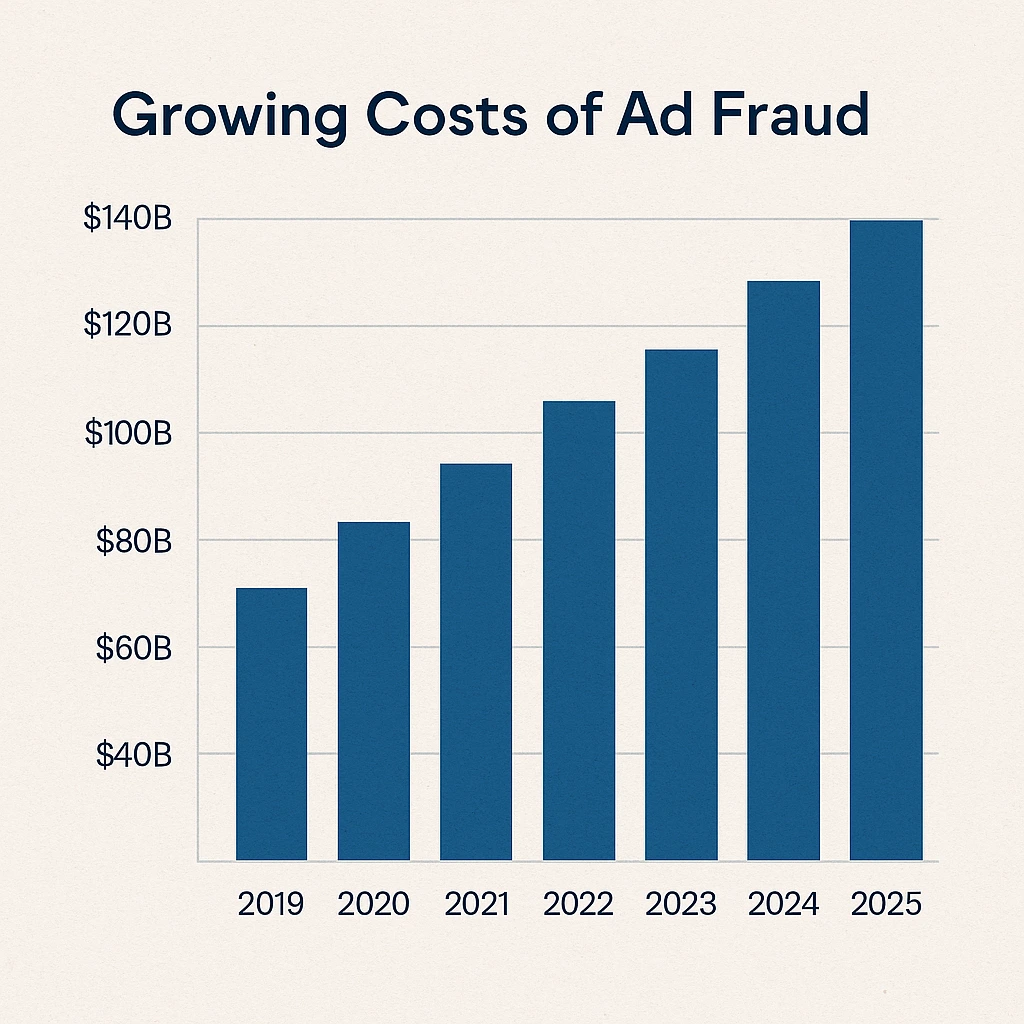

According to a report by Juniper Research, ad fraud is expected to cost businesses over $100 billion annually by 2025. This staggering figure highlights the scale of the problem and why ad fraud detection is no longer optional but essential for advertisers.

Why Click Fraud Is a Growing Threat

The rise of sophisticated technology has made it easier for fraudsters to mimic genuine user behavior. Bots can now simulate human clicks, including scrolling, hovering, and even filling out forms. Meanwhile, click farms—operations where low-paid workers manually click on ads—continue to thrive in regions with lax regulations.

Platforms like Google and Meta have invested heavily in fraud detection, but no system is foolproof. For performance marketers managing tight budgets, even a small percentage of invalid clicks can ruin a campaign’s return on investment (ROI). The financial and reputational damage can be devastating, especially for businesses reliant on paid ads for growth.

How Click Fraud Works on Major Platforms

Google Ads: Bots and Competitor Sabotage

Google Ads operates on a PPC model where advertisers bid on keywords and pay for each click. Fraudsters exploit this by using bots to repeatedly click on ads, draining budgets without any intent to engage. Competitors might also engage in click fraud by manually clicking on your ads to increase your costs and push you out of the auction.

Google does have systems in place to detect and filter out invalid clicks, and they often issue refunds for detected fraud. However, their detection isn’t perfect, and some fraudulent activity slips through the cracks. For more details on Google’s policies, refer to their official invalid clicks policy.

Meta Ads: Click Farms and Fake Accounts

On Meta platforms like Facebook and Instagram, click fraud often involves fake accounts or click farms. These operations create the illusion of engagement by clicking on ads, liking posts, or even commenting. The goal is often to inflate costs for advertisers or to make a fraudulent publisher appear more credible.

Meta uses machine learning to detect suspicious activity, but the sheer volume of users and ads makes it challenging to catch every instance of fraud. Small businesses running niche campaigns are particularly vulnerable since their limited budgets can’t absorb the cost of repeated fraudulent clicks.

The Impact of Click Fraud on Your Business

Financial Losses

The most immediate impact of click fraud is financial loss. Every fraudulent click siphons money from your budget without delivering potential customers. For a small business spending $1,000 a month on ads, losing even 20% to fraud means $200 down the drain—money that could have been invested elsewhere.

Skewed Data and Poor Decision-Making

Beyond direct costs, click fraud distorts your campaign data. High click-through rates (CTR) from bots might make a campaign appear successful on paper, leading to misguided optimizations. Over time, this can result in poor targeting, wasted resources, and missed opportunities to reach real customers.

Reputation Damage

If fraud goes undetected for too long, it can damage your trust in digital advertising platforms. Worse, if bots or click farms engage with your ads in ways that trigger penalties (like violating ad policies), your account could face suspension, further harming your business’s online presence.

Detecting Click Fraud: Signs and Tools

Key Signs of Click Fraud

Detecting click fraud early can save you from significant losses. Here are some red flags to watch for in your campaign data:

- Unusually High CTR: If your click-through rate spikes without a corresponding increase in conversions, it could indicate bot activity.

- Low Session Duration: Clicks that result in users leaving your site almost immediately often come from bots or uninterested parties.

- Geographic Anomalies: A surge in clicks from unexpected regions (e.g., countries outside your target market) could signal click farms.

- Repetitive IP Addresses: Multiple clicks from the same IP address in a short time frame are a strong indicator of fraud.

Tools for Ad Fraud Detection

Several tools and platforms can help you identify and mitigate click fraud. Below is a table summarizing some popular options:

| Tool | Key Features | Pricing | Best For |

|---|---|---|---|

| ClickCease | Real-time click monitoring, IP blocking, competitor tracking | Starting at $15/month | Small to medium businesses |

| PPC Protect | Automated fraud detection, detailed reporting, integration with Google Ads | Starting at $50/month | Agencies and larger campaigns |

| TrafficGuard | AI-powered fraud prevention, cross-platform protection | Custom pricing | Enterprise advertisers |

Using these tools as part of your PPC protection strategy can significantly reduce your risk of falling victim to fraud. Many of them integrate directly with platforms like Google Ads, making setup quick and seamless.

Strategies for Click Fraud Prevention

Refine Your Targeting

One of the most effective ways to reduce invalid clicks is to narrow your audience targeting. Exclude irrelevant demographics, locations, or devices that are unlikely to convert. For instance:

- Use negative keywords in Google Ads to prevent your ads from showing for unrelated searches.

- Set geographic restrictions to focus only on regions where your customers are located.

- Limit ad displays to specific times of day when your audience is most active.

Monitor Campaigns in Real-Time

Regularly review your campaign analytics to spot anomalies early. Platforms like Google Ads and Meta Ads Manager provide detailed reports on click sources, IP addresses, and user behavior. Set up alerts for sudden spikes in clicks or suspicious activity to take immediate action.

Use IP Exclusion and Blocking

Most ad platforms allow you to exclude specific IP addresses or ranges from seeing your ads. If you notice repeated clicks from the same IP with no conversions, block it. Tools like ClickCease can automate this process, saving you time and effort.

Leverage Retargeting and Lookalike Audiences

Retargeting focuses your ads on users who have already interacted with your brand, reducing the likelihood of random or fraudulent clicks. Similarly, lookalike audiences on Meta can help you reach users similar to your existing customers, improving the quality of your traffic.

Work With Ad Platforms for Refunds

If you suspect click fraud, report it to the platform immediately. Google Ads, for instance, offers an invalid click investigation form where you can request a refund for fraudulent activity. Be prepared to provide detailed data to support your claim.

Case Studies: Real-World Examples of Click Fraud

Small Business Hit by Competitor Fraud

A small e-commerce store running Google Ads noticed a sudden spike in clicks but no increase in sales. After analyzing their data, they found repetitive clicks from a single IP address—likely a competitor trying to exhaust their budget. By using IP exclusion and tightening their geographic targeting, they reduced fraudulent clicks by 60% within a month.

Agency Saves Client Budget with Fraud Detection Tools

A digital marketing agency managing Meta Ads for a client detected suspicious activity from click farms in unrelated countries. By implementing TrafficGuard’s fraud detection software and refining the campaign’s audience settings, they saved the client over $5,000 in a single quarter, redirecting those funds to genuine leads.

Future Trends in Click Fraud and Ad Protection

Advancements in AI and Machine Learning

As fraudsters become more sophisticated, ad platforms and third-party tools are leveraging AI to stay ahead. Machine learning algorithms can now detect patterns of bot behavior with higher accuracy, flagging suspicious activity before it spirals out of control.

Stricter Regulations and Industry Standards

Governments and industry bodies are beginning to crack down on ad fraud with stricter regulations. The Interactive Advertising Bureau (IAB) and other organizations are working on standardized practices to improve transparency and accountability in digital advertising.

For more insights into emerging trends, check out the IAB’s official website for the latest research and guidelines.

Conclusion: Safeguarding Your Ad Spend for Long-Term Success

Click fraud is a pervasive and costly problem that can erode your marketing budget and skew your campaign performance. From bots on Google Ads to click farms on Meta, the sources of invalid clicks are diverse, but the impact is consistently damaging. However, by understanding how fraud works, staying vigilant with monitoring, and leveraging tools for ad fraud detection, you can significantly reduce your risk.

Adopting PPC protection strategies—such as refined targeting, real-time analytics, and IP blocking—empowers you to focus your budget on genuine leads. As technology evolves, so too will the methods of fraudsters, making it crucial to stay informed and proactive. Protecting your ad spend isn’t just about saving money today; it’s about building trust in digital advertising for sustainable growth tomorrow. Take the first step by auditing your current campaigns and exploring the click fraud prevention tools mentioned in this guide. Your budget—and your business—deserve nothing less.

Ready to up your paid media game? See our services here.

FAQs

What percentage of ad clicks are typically fraudulent?

Industry studies show that click fraud rates vary significantly by sector and platform, but generally range from 14% to 30% of all ad clicks. According to the Association of National Advertisers (ANA), digital ad fraud accounts for approximately 20% of ad spend globally.Recent data from the Interactive Advertising Bureau (IAB) indicates that sophisticated fraud schemes can affect up to 22% of programmatic advertising, while a 2023 report by ClickCease found that some industries like legal services and insurance can experience fraud rates exceeding 25%. The financial impact is substantial, with TrafficGuard estimating that businesses lose an average of $1 out of every $5 spent on digital advertising to fraudulent activities.

These percentages tend to be higher for broadly targeted campaigns and lower for highly specific, well-optimized campaigns with strong protection measures in place.

How much money can a small business save by implementing click fraud protection?

Small businesses implementing click fraud protection typically save between 15-25% of their ad budget, which directly translates to real dollars saved. For a business spending $2,000 monthly on PPC advertising, this represents potential savings of $300-$500 per month or $3,600-$6,000 annually.A 2023 study by PPC Protect analyzed over 5,000 small business accounts and found that those implementing fraud protection tools recovered an average of 18.7% of their previous ad spend within the first three months. The ROI on fraud protection solutions is typically positive, with businesses seeing an average return of $3.20 for every $1 invested in protection tools.

Importantly, these savings improve campaign performance metrics beyond just cost, with protected campaigns showing 22% better conversion rates on average due to higher quality traffic.

Do Google and Meta refund money for fraudulent clicks that they detect?

Yes, both Google and Meta do provide refunds for detected fraudulent clicks, but the refund process and coverage have significant limitations. Google Ads automatically credits accounts for invalid clicks detected by their systems, typically appearing as adjustments in your billing statements. According to Google, they filter billions of invalid clicks before they’re even charged to advertisers.However, a 2022 industry survey by Click Guardian found that Google’s automatic detection catches only about 60-70% of total fraudulent activity. For clicks that slip through their automated systems, advertisers can submit an invalid click investigation form, though success rates for manual claims are relatively low (approximately 10-15% approval rate).

Meta has a similar policy of automatically filtering invalid activities and providing credits, though they’re generally less transparent about their detection rates. Their 2023 Community Standards Enforcement Report stated they took action on over 1.8 billion fake accounts, many involved in click fraud schemes.

Both platforms typically only refund for the most obvious cases of fraud, leaving many borderline or sophisticated fraud cases unaddressed, which is why third-party protection remains valuable.

How can I tell if my specific industry is particularly vulnerable to click fraud?

Certain industries consistently show higher vulnerability to click fraud due to factors like higher cost-per-click (CPC) rates and competitive intensity. According to ClickCease’s 2023 Industry Risk Assessment, the most targeted industries include:- Legal services (particularly personal injury and divorce law): 28-34% fraud rate

– Insurance: 25-30% fraud rate

– Financial services and loans: 22-27% fraud rate

– Healthcare and medical services: 20-24% fraud rate

– Home services (plumbing, HVAC, roofing): 18-23% fraud rate

You can assess your industry’s vulnerability by monitoring several key indicators in your campaigns:

1. Compare your conversion rates to industry benchmarks – significantly lower rates may indicate fraud

2. Analyze your bounce rates – industries experiencing high fraud typically see bounce rates exceeding 70%

3. Review geographic data for clicks from regions where you don’t operate or expect customers

4. Monitor for click spikes during unusual hours that don’t align with typical customer behavior

Many fraud protection tools offer free audits that can provide a detailed assessment of your specific campaign’s vulnerability based on historical data.

What are the newest techniques fraudsters are using to evade detection?

Fraudsters are constantly evolving their techniques, with several sophisticated methods emerging in recent years. According to the 2023 Ad Fraud Trends Report by TrafficGuard, the most advanced evasion techniques now include:1. Machine learning-powered bots that mimic human behavior by creating realistic mouse movements, scroll patterns, and site interactions. These advanced bots can even simulate conversion actions, making them 40% harder to detect than previous generation bots.

2. Residential proxy networks that route fraudulent clicks through legitimate residential IP addresses rather than data centers. These networks can rotate through millions of legitimate-looking IPs, making traditional IP blocking ineffective. A 2023 study found these proxies involved in approximately 35% of sophisticated fraud schemes.

3. Device fingerprint manipulation that alters browser configurations and device signatures between clicks to appear as different users. This technique can bypass up to 70% of basic fraud detection systems.

4. Session hijacking through malware that piggybacks on real users’ sessions, making fraudulent clicks appear to come from legitimate users with normal behavior patterns.

5. Distributed low-frequency attacks that spread fraudulent activities across many sources rather than concentrated patterns, staying below traditional detection thresholds.

Staying protected against these evolving threats requires continual updates to detection systems and increasing reliance on behavioral analysis rather than simple rule-based blocking.

How does click fraud impact mobile app advertising compared to web advertising?

Mobile app advertising experiences different click fraud patterns compared to traditional web advertising, with some distinct characteristics according to recent data:Mobile app fraud rates are approximately 15% higher than web-based fraud according to AppsFlyer’s 2023 State of Mobile Fraud Report, which found that 26.1% of mobile app installs worldwide were fraudulent. This is driven by several factors specific to the mobile ecosystem:

Install farms are particularly problematic for mobile advertising, where low-wage workers manually download, install and interact with apps to generate fake attribution data. A single install farm operation in Southeast Asia detected in 2022 was responsible for over 4.6 million fraudulent installs.

SDK spoofing, where fraudsters manipulate app attribution data to simulate installations without actually downloading apps, accounts for approximately 37% of all app install fraud according to Adjust’s Mobile Fraud Prevention Report.

Mobile fraud is also more likely to involve sophisticated techniques like device emulation, with one study finding that a single emulated device can generate up to 8,000 fraudulent actions per day while appearing as unique devices to advertisers.

On the positive side, Apple’s App Tracking Transparency (ATT) framework introduced in iOS 14 has reduced certain types of mobile ad fraud by limiting data access, with fraud rates on iOS dropping by 17% following implementation compared to Android.

What legal recourse do businesses have if they discover they’ve been victims of click fraud?

Businesses facing significant click fraud have several legal options, though each comes with challenges:Civil lawsuits can be filed against identified perpetrators under various legal theories including fraud, breach of contract, unfair business practices, and computer fraud. In a landmark 2023 case, a mid-sized e-commerce company successfully recovered $1.2 million in damages from a competitor engaging in systematic click fraud.

Class action lawsuits have been pursued against ad platforms for inadequate fraud prevention. A 2022 class action against a major ad network resulted in a $38 million settlement distributed among affected advertisers who could demonstrate financial harm.

Some jurisdictions have specific computer crime statutes that apply to click fraud. The U.S. Computer Fraud and Abuse Act has been successfully used in several cases, with penalties including both criminal charges and civil damages.

The primary challenge in legal action is evidence gathering—proving who conducted the fraud and quantifying damages often requires sophisticated digital forensics. According to legal data, cases with third-party fraud detection documentation have a 340% higher success rate.

Before pursuing legal action, most businesses should first exhaust platform remedies by filing complaints with the advertising platforms and requesting refunds, as courts generally require this step before considering litigation. Legal action is typically most viable for cases involving damages exceeding $50,000, as litigation costs can otherwise outweigh potential recovery.